The simplest way to invest in stocks is to buy exchange traded funds. But investors can boost returns by picking market-beating companies to own shares in. To wit, the Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH) share price is 65% higher than it was a year ago, much better than the market return of around 14% (not including dividends) in the same period. That's a solid performance by our standards! And shareholders have also done well over the long term, with an increase of 41% in the last three years.

In light of the stock dropping 5.6% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive one-year return.

View our latest analysis for Norwegian Cruise Line Holdings

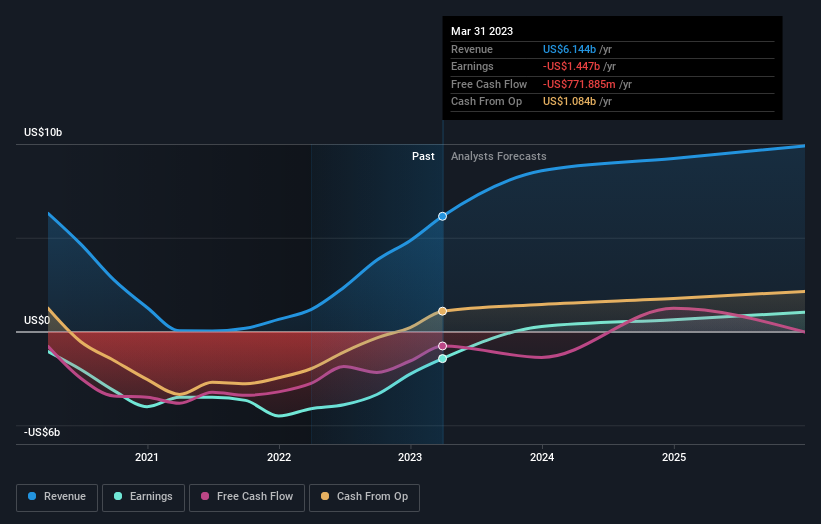

Given that Norwegian Cruise Line Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last twelve months, Norwegian Cruise Line Holdings' revenue grew by 427%. That's stonking growth even when compared to other loss-making stocks. The solid 65% share price gain goes down pretty well, but it's not necessarily as good as you might expect given the top notch revenue growth. So quite frankly it could be a good time to investigate Norwegian Cruise Line Holdings in some detail. Since we evolved from monkeys, we think in linear terms by nature. So if growth goes exponential, opportunity may exist for the enlightened.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Norwegian Cruise Line Holdings stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It's good to see that Norwegian Cruise Line Holdings has rewarded shareholders with a total shareholder return of 65% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 10% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Norwegian Cruise Line Holdings better, we need to consider many other factors. For instance, we've identified 3 warning signs for Norwegian Cruise Line Holdings (1 makes us a bit uncomfortable) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

"though" - Google News

July 19, 2023 at 06:29PM

https://ift.tt/adDibux

Even though Norwegian Cruise Line Holdings (NYSE:NCLH) has lost US$534m market cap in last 7 days, shareholders are still up 65% over 1 year - Yahoo Finance

"though" - Google News

https://ift.tt/wvAXsUQ

https://ift.tt/5NPSn7m

Bagikan Berita Ini

0 Response to "Even though Norwegian Cruise Line Holdings (NYSE:NCLH) has lost US$534m market cap in last 7 days, shareholders are still up 65% over 1 year - Yahoo Finance"

Post a Comment