When you buy a stock there is always a possibility that it could drop 100%. But when you pick a company that is really flourishing, you can make more than 100%. For instance, the price of Alphabet Inc. (NASDAQ:GOOGL) stock is up an impressive 114% over the last five years. It's also good to see the share price up 24% over the last quarter. But this could be related to the strong market, which is up 11% in the last three months.

Since the stock has added US$148b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Alphabet

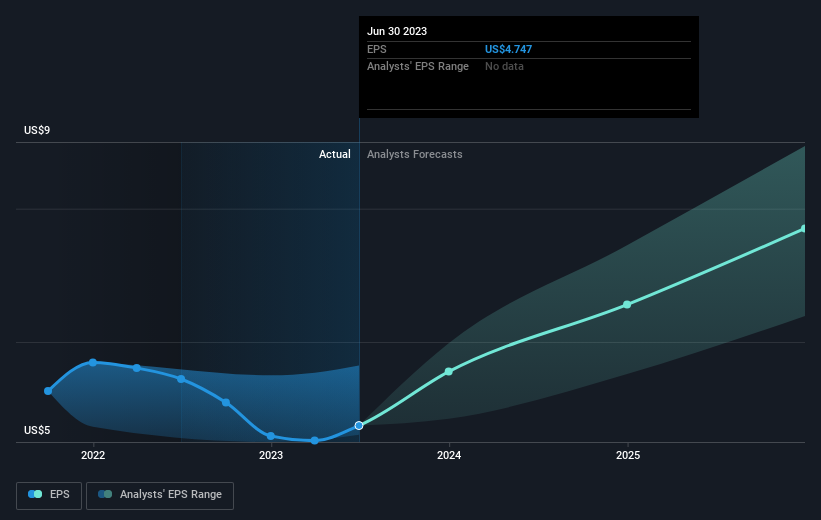

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over half a decade, Alphabet managed to grow its earnings per share at 33% a year. This EPS growth is higher than the 16% average annual increase in the share price. Therefore, it seems the market has become relatively pessimistic about the company.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Alphabet's key metrics by checking this interactive graph of Alphabet's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Alphabet shareholders have received a total shareholder return of 14% over the last year. However, that falls short of the 16% TSR per annum it has made for shareholders, each year, over five years. Before forming an opinion on Alphabet you might want to consider these 3 valuation metrics.

Of course Alphabet may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

"though" - Google News

July 29, 2023 at 09:00PM

https://ift.tt/wTNtxoD

Alphabet (NASDAQ:GOOGL) jumps 10% this week, though earnings growth is still tracking behind five-year shareholder returns - Yahoo Finance

"though" - Google News

https://ift.tt/MgRsdWj

https://ift.tt/TjywFNK

Bagikan Berita Ini

0 Response to "Alphabet (NASDAQ:GOOGL) jumps 10% this week, though earnings growth is still tracking behind five-year shareholder returns - Yahoo Finance"

Post a Comment