Fulgent Genetics, Inc. (NASDAQ:FLGT) shareholders might be concerned after seeing the share price drop 24% in the last quarter. But that doesn't undermine the fantastic longer term performance (measured over five years). In fact, during that period, the share price climbed 891%. Impressive! So it might be that some shareholders are taking profits after good performance. Of course what matters most is whether the business can improve itself sustainably, thus justifying a higher price. While the long term returns are impressive, we do have some sympathy for those who bought more recently, given the 60% drop, in the last year. It really delights us to see such great share price performance for investors.

In light of the stock dropping 6.6% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

Check out our latest analysis for Fulgent Genetics

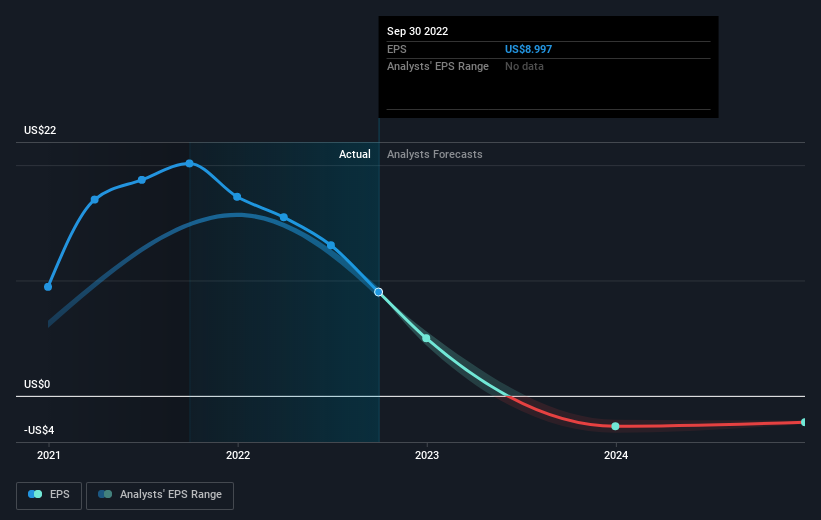

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last half decade, Fulgent Genetics became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Fulgent Genetics has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market lost about 18% in the twelve months, Fulgent Genetics shareholders did even worse, losing 60%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 58% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Fulgent Genetics (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Fulgent Genetics is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

"though" - Google News

December 09, 2022 at 06:30PM

https://ift.tt/cVQGxwl

Even though Fulgent Genetics (NASDAQ:FLGT) has lost US$72m market cap in last 7 days, shareholders are still up 891% over 5 years - Simply Wall St

"though" - Google News

https://ift.tt/Jg0UWlq

https://ift.tt/8McrRAf

Bagikan Berita Ini

0 Response to "Even though Fulgent Genetics (NASDAQ:FLGT) has lost US$72m market cap in last 7 days, shareholders are still up 891% over 5 years - Simply Wall St"

Post a Comment