It hasn't been the best quarter for Bombardier Inc. (TSE:BBD.B) shareholders, since the share price has fallen 11% in that time. But over three years the performance has been really wonderful. The longer term view reveals that the share price is up 561% in that period. Arguably, the recent fall is to be expected after such a strong rise. Only time will tell if there is still too much optimism currently reflected in the share price. Anyone who held for that rewarding ride would probably be keen to talk about it.

While the stock has fallen 4.1% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

See our latest analysis for Bombardier

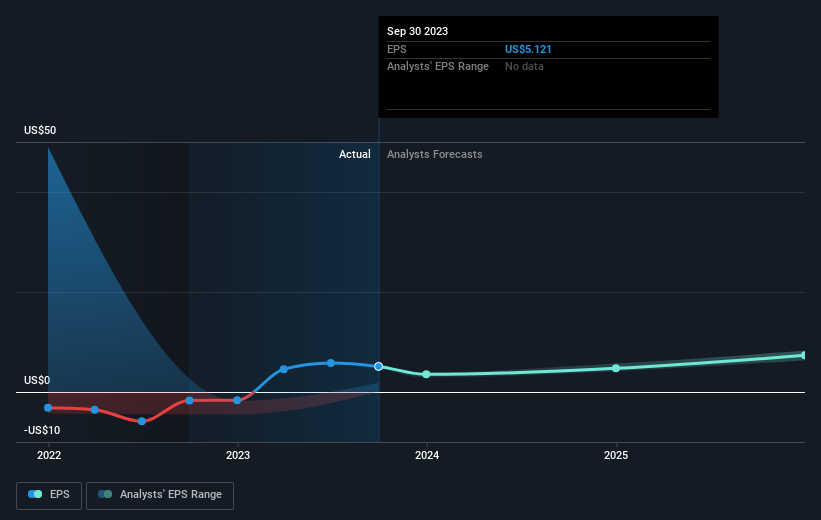

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, Bombardier moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. This free interactive report on Bombardier's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Bombardier shareholders have received a total shareholder return of 18% over the last year. There's no doubt those recent returns are much better than the TSR loss of 1.3% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Bombardier better, we need to consider many other factors. Even so, be aware that Bombardier is showing 3 warning signs in our investment analysis , you should know about...

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

"though" - Google News

November 15, 2023 at 11:01PM

https://ift.tt/yJLMUe2

Even though Bombardier (TSE:BBD.B) has lost CA$201m market cap in last 7 days, shareholders are still up 561% over 3 years - Yahoo Finance

"though" - Google News

https://ift.tt/xl3o4gO

https://ift.tt/3biAdEC

Bagikan Berita Ini

0 Response to "Even though Bombardier (TSE:BBD.B) has lost CA$201m market cap in last 7 days, shareholders are still up 561% over 3 years - Yahoo Finance"

Post a Comment