Despite low home inventory, many lenders are still maintaining a healthy mix of purchase loan business. The Mortgage Bankers Association estimates a 9% increase to a record new purchase volume of $1.73 trillion for 2022. As mortgage lenders begin to rely more on purchase volume to support their growth, emphasis is being placed on increasing efficiency in processing these loans.

Why are Purchase Loans a Challenge for Mortgage Processors?

Purchase loans create unique challenges for lender processing, compliance, underwriting and funding teams, particularly when it comes to closing the loan. With refi transactions lenders typically work with a smaller pool of hand-picked title companies and settlement agents.

These agents are well vetted and integrated with the lender’s process and systems. By sending a large volume of loans to this small pool of vendors other important aspects of the relationship are easier to manage such as due diligence, data management and score carding of performance.

Now here comes a purchase agreement. The borrower’s real estate agent has opened escrow with their preferred vendor. This vendor is new to our organization so they must go through our vendor management process. Their data must be collected, verified and entered again into the LOS by the processor, and accurately populated into disclosures.

This infrequency of volume forces processors to continuously follow a repetitive process to collect and verify data for their LOS system. Licensing alone requires in-depth local knowledge of practices and which sources can be used for verification. Repeated entry creates duplicate records and other technical challenges for LOS system admins.

Using New Technology and New Approaches

Forward-thinking lenders are already adopting new technology to help their processing teams solve the challenges of document/data collection and verification. Chances are your organization is already using a data service provider to obtain information from borrowers. Employment, Income and Asset verifications were once a huge challenge, but now that data is instantly available in most cases and integrated with your LOS.

The same technology, approach and benefits can also be made available to your internal teams that work with third-party vendors. Instead of waiting for documents such as E&O, Wire and Licensing to come with the title package, this information can be obtained instantly and earlier in the process.

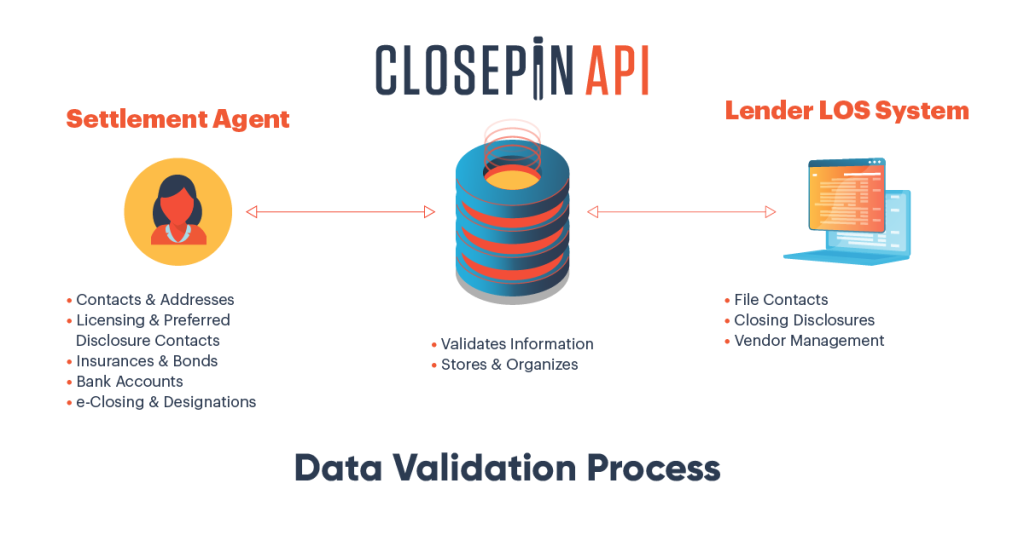

That was our goal when we created Closepin. To help thousands of local closing agents manage their own information securely, while giving lenders an API based solution that can distribute verified data where it’s needed.

Now title and settlement agents have more control over their data and lenders can consume this data in a standardized and LOS-friendly format. This eliminates entry errors and hours of back and forth communication to verify information that was previously only provided via PDF based documents.

LOS administrators and their partners in vendor management can now properly track and evaluate a large network of third-party title and settlement agents as seamlessly as they do with other types of vendors. These are the steps that help lenders work toward achieving the bigger goal, which is to create a consistent, fully digital and integrated experience for their borrowers and their internal teams.

Talk To Your Team

Chances are your vendor managers, compliance managers and loan processors might be stuck trying to manually manage thousands of incoming PDF documents, while using a variety of third-party sources to verify data from title and settlement agents.

This presents a challenge for many lenders as regulators continue to increase requirements for oversight and vendor management, while the lender is looking to reduce the number of steps to perform to meet the increasing demand for a faster transaction. Most teams handling this process manually could be quickly overwhelmed.

By equipping your teams with tools and data sources that instantly give them the data needed to perform their work, your organization can increase efficiency and compliance at the same time.

For more information about the Closepin API visit https://www.closepin.com/ to request a free process consultation.

"processing" - Google News

February 07, 2022 at 10:09PM

https://ift.tt/2QdIPJC

How to solve purchase loan processing challenges - HousingWire

"processing" - Google News

https://ift.tt/a1Su2zp

https://ift.tt/ZQPiV7K

Bagikan Berita Ini

0 Response to "How to solve purchase loan processing challenges - HousingWire"

Post a Comment